Acquiring: RUSSIAN STANDARD BANK – SBP, Visa, MasterCard, Mir, UnionPay, and others

Acquiring for your site: SBP, payment with Visa, MasterCerd, Mir cards, preauthorization by SBP, saving payment cards, holding payment, automatic status change, connection to the OFD, connection and configuration of the online cash register, debiting funds from an authorized card, creating an order for the buyer manually.

Advantages of the Russian Standard Bank

Russian Standard Bank is one of the four largest banks in Russia. It was the Russian standard that was the first in Russia to launch payment for purchases using a QR code through the SBP. Today, the Russian Standard offers two payment options using a QR code:

- Static code: generated once and posted on the website or at the point of sale, the price can be rigidly set or generated for each buyer separately,

- Dynamic code: a unique code is generated for each purchase and displayed on the screen of a monitor, smartphone or terminal.

The Russian standard offers online acquiring connection, without visiting the bank's office. It's fast, convenient, and saves a lot of time. The registration will take no more than 15 minutes.

The bank supports the possibility of payment with tips. It is convenient for services for the sale of services: cosmetics, cosmetology, massage, repair. The client can additionally thank the master, and this will require no more than a few additional movements from the client.

Another nice bonus is round–the-clock legal support for medium and small businesses.

Who is suitable for the module

The module is designed to work in all areas of business and allows you to implement various scenarios, such as:

- Online store: goods and services,

- Marketplace: goods and services,

- Delivery by courier of the marketplace or online store,

- Delivery by the seller's courier,

- PVZ of a marketplace or online store,

- Seller's PVZ,

- Offline point of sale.

The module supports the implementation of scenarios of an online store, marketplace and offline outlet on one online sales register, without connecting a separate device for each business area.

Online Store

Selling your own goods and/or services over the Internet.

- Accepting payments by Visa, MasterCard, MIR, UnionPay,

- Acceptance of payments under the SBP,

- Saving the buyer's payment card (for Visa, MasterCard and Mir payment systems),

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding.

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa).

Marketplace

The organization of the marketplace, including according to the agency scheme: the seller (vendor, seller, merchant) uploads his goods to the marketplace and puts them on display, the buyer selects the goods and makes a purchase. At the time of payment, information about the transaction goes to the tax service, including: the sign of work under the agency scheme, the name of the owner of the goods, his TIN, the type of taxation, the amount of tax. All funds are credited to the marketplace account, and then the marketplace transfers the amount due to the seller. The seller pays taxes from it on his own. The marketplace does not pay tax on the entire amount credited to its account, but only on its profits.

Combined work schemes are possible, for example, according to the marketplace + online store scenario, when the marketplace sells its own goods too.

- Accepting payments by Visa, MasterCard, MIR, UnionPay,

- Acceptance of payments under the SBP,

- Saving the buyer's payment card (for Visa, MasterCard and Mir payment systems),

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding,

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa),

- Support for the agency work scheme,

- The ability to connect sellers under their contract without the possibility of saving payment cards.

Offline point of sale

It is not uncommon for owners of online stores, and marketplaces, to organize not only a website, but also retail points of sale, which also need to be equipped with cash desks, and accept payments, including cash.

Our module allows you to use an online cash register at an offline point of sale instead of a stationary cash register, which allows you to significantly save money, reduce costs at the initial stage of store development or implement complex business schemes.

In particular, it allows you to implement several interesting scenarios that will make working with offline clients easier and more convenient.

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding,

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa.

Courier delivery of an online store or marketplace

The courier delivers the customer's order, receives payment in cash or via online transfer, issues goods, changes the status of the order to "Completed", ensuring compliance with the law. All necessary information is sent to the OFD, and a receipt is sent to the buyer by e-mail or SMS.

- Acceptance of payments under the SBP,

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding,

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa).

Courier delivery of the seller

The seller's courier delivers the order, issues an electronic receipt to the buyer's mail or phone. The money is credited to the seller's account.

- Acceptance of payments under the SBP,

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding,

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa).

PVZ of an online store or marketplace

Order pick-up points are a convenient and popular way to receive orders from online stores and marketplaces. In particular, because there you can inspect the goods before purchasing, try them on and decide whether to buy back the goods.

A PVZ employee can either issue already paid goods, or accept payment in cash or online transfer. To do this, it is enough for him to change the status of the product to "Paid" after receiving the money, after which the information about the sale will automatically go to the OFD, and an electronic receipt will be sent to the buyer by mail or SMS.

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding,

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa).

Seller's PVZ

The product is delivered to the seller's pick-up point, the buyer comes for the order, pays for it and receives the order by hand. The PVZ employee changes the status of the order to "Paid", information about the completion of the transaction is automatically sent to the OFD, and the buyer receives an electronic receipt by mail or SMS.

The money is credited to the seller's account. Later, the marketplace and the seller conduct their mutual settlements based on data from the warehouse accounting program.

- Automatic change of order statuses by payment statuses,

- Automatic change of payment status by order status,

- Payment holding,

- OFD connection,

- Connecting online sales registers (PayKeeper Kassa, ATOL Online, OrangeData, Kit Online, BusinessKassa).

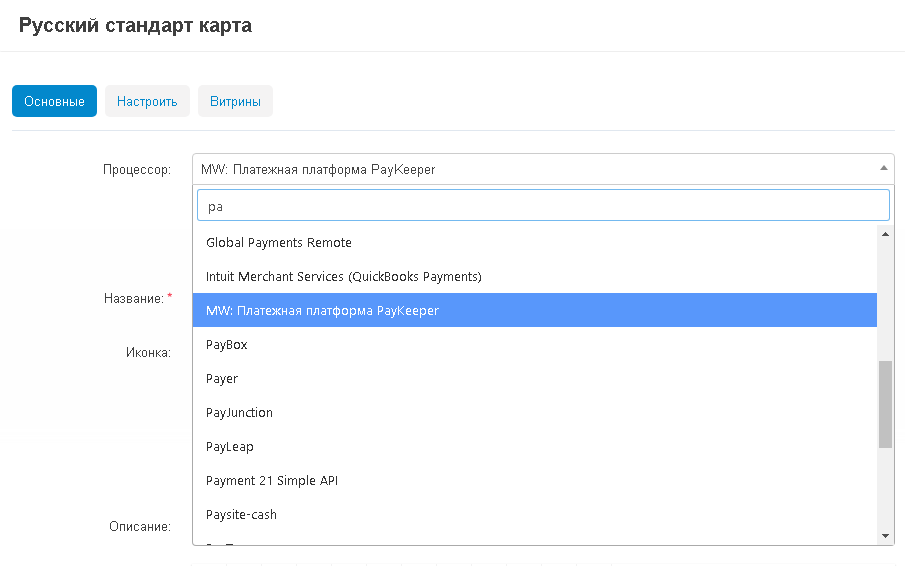

Functionality of the integration module with the Russian bank for CS-Cart and Multi-Vendor

The functionality of the integration module realizes the full potential of the bank's capabilities, taking into account all business processes. We are preparing several important and interesting updates that significantly expand the capabilities of the module.

Accepting payment cards

The module supports accepting payments by cards of all major payment systems: Visa, MasterCard, UnionPay, Mir and others. For Mir, Visa, MasterCard cards, the function of saving card data is supported.

Acceptance of payment by SBP

The fast payment system is an actively developing and popular payment method that is convenient for both buyers and sellers. SBP is a low interest rate, ease of use, and the ability to save a token (it works on approximately the same principle as saving payment cards).

Accepting payments from abroad

List of countries and banks available for transfer:

- Azerbaijan: Muganbank, Yelo Bank;

- Belarus: BNB-Bank, BTA Bank;

- Bosnia and Herzegovina: Asa Banka DD Sarajevo;

- United Kingdom: BFC Bank;

- Kazakhstan: Freedom Finance Kazakhstan, Eurasian Development Bank;

- Kyrgyzstan: Bakai Bank, Bai-Tushum Bank, Capital Bank, Kyrgyzstan Bank, DemirBank, FinansCreditBank, Keremet Bank, Kyrgyzkommertsbank, Kyrgyz-Swiss Bank;

- Moldova: BC "COMMERTBANK";

- Mongolia: Khan Bank; Serbia: API Bank, Expobank, Srpska Banka;

- Tajikistan: Alif Bank, Commerzbank of Tajikistan, Dushanbe City Bank, Bank Eskhata, International Bank of Tajikistan, Orienbank, Spitamen Bank, Tavkhidbank;

- Uzbekistan: Davr Bank, Hamkorbank,

- All banks in Georgia and Armenia.

The list of services and countries is current at the time of publication (November 2023). Check the relevance of the data with the bank's employees.

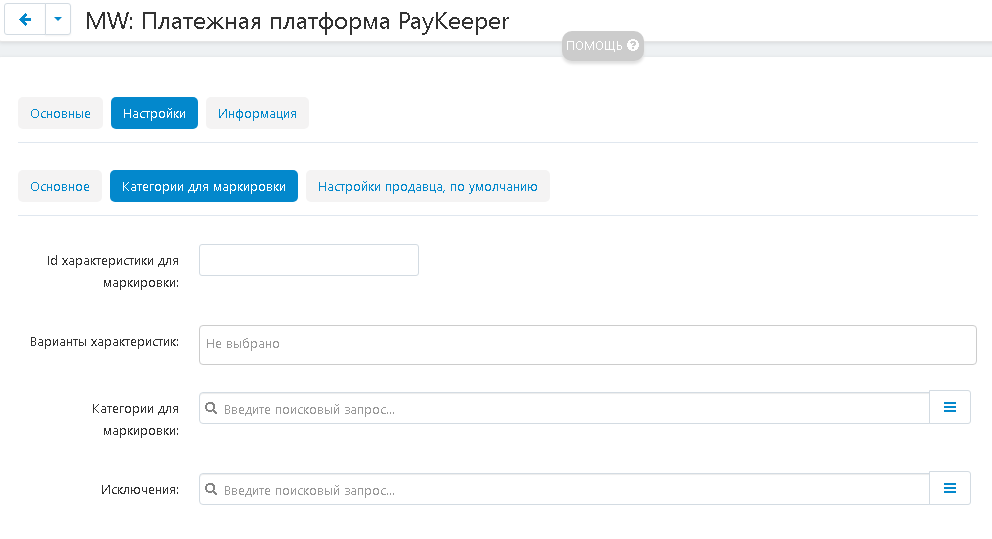

Marking is an honest sign

According to the legislation, a number of goods are subject to mandatory labeling "Honest mark". Each product is assigned a unique identifier, and the departure of this unit of goods from circulation occurs only through the CRF, that is, along with information about the transaction, the tax service must also receive the identifier of the Honest Mark for this particular product.

The module automatically sends the Fair Sign identifier to the OFD at the time of completion of the transaction, so the legislation will be complied with without additional efforts on your part.

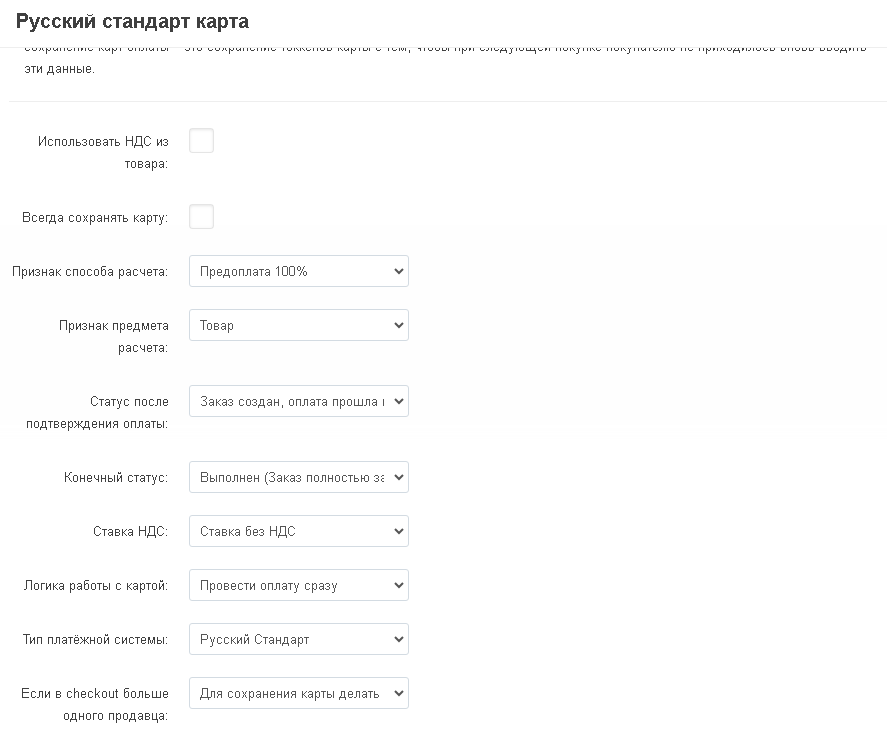

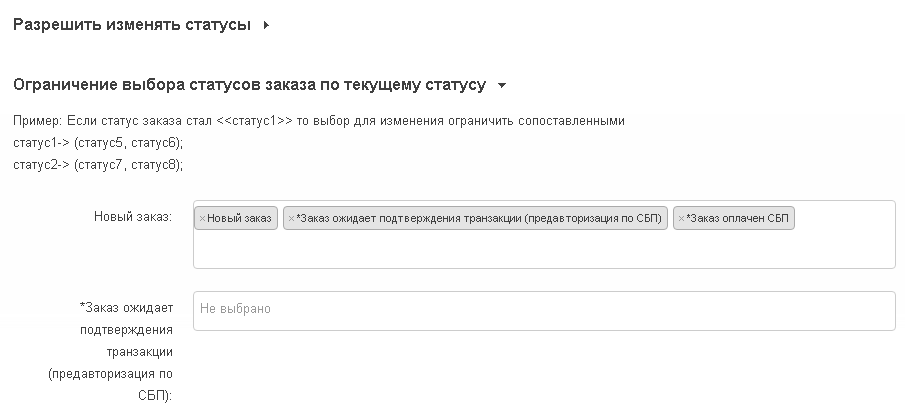

Automatic change of order statuses by transaction status

When placing an order from the checkout, the buyer gets to the bank's widget, where he needs to enter payment details and confirm his willingness to pay for the purchase. Further events can develop according to one of several scenarios:

- The money was debited from the account, the payment was completed,

- There is not enough money in the account, the payment has not been completed,

- The card is blocked, the payment has not been completed,

- The buyer canceled the payment himself.

The module receives a response from the bank and automatically changes the order status to the appropriate one. Thus, the following scenarios are triggered: if the payment has passed, the order is processed, it is completed, packaged and sent to the buyer; if the buyer canceled the order himself, the goods will remain in the checkout for subsequent ordering, and so on.

Automatic change of the order status allows you to track all events that occur with the order. In case something goes wrong, you can always figure it out by the flexibly configurable statuses.

Automatic change of order statuses by transaction status

By law, when accepting payment, we are obliged to give the buyer a receipt confirming that the transaction has been completed, and after handing the goods to the buyer, it is necessary to knock out a closing receipt. Either the courier or the transport company informs us that the buyer has received his goods.

The module automatically accepts order delivery information from third-party modules, for example, the PRO PLUS Delivery module, and changes the transaction status according to the order status. After the goods are delivered to the buyer, the order status will be changed to "Order completed", at which point a closing receipt is issued.

Saving payment cards

Today, online stores and marketplaces are literally one click away from each other. And any delay, any delay in the purchase of goods can lead the buyer from one site to another.

And now the buyer comes to making a purchase. Now he needs to open the bag, take out the wallet, take out the card from it, rewrite its number, expiration date, CSV. It may take up to 5 minutes. If someone distracts the customer at this stage, they can simply close your store, return to the purchase later, but find the right product on another site.

Saving payment cards allows you to significantly increase the conversion rate for those who buy goods in your store repeatedly. He no longer needs to do all the steps described above, just select the saved card and click the "Pay" button. Even if the buyer has important things to do right now, he will have time to press two buttons.

The card data is saved automatically when making a purchase.

Payment holding

Holding – from the English "Hold" - hold – withholding of payment. After creating an order on the bank's side, the funds are frozen: they remain on the buyer's account, but he cannot use them. Thus, you have a 100% guarantee that you will receive money from the buyer. Funds are debited after a predetermined event occurs: for example, confirmation of the availability of goods, or confirmation of the order by the buyer.

Funds are frozen on the buyer's account for a maximum period of 5 days. If the command to withdraw funds does not arrive during this period, the funds will either be automatically unblocked on the buyer's account, or transferred to your account.You can set up an action after the expiration date in your personal account.

After the money from the buyer's account is credited to your account, the order status changes to "Paid". After that, everything develops according to the standard scenario.

This is a convenient and useful feature that allows you to significantly save on acquiring. After all, if the buyer pays for the product, but it does not turn out to be in stock, the money has to be returned, but at the same time no one will refund you the interest paid for acquiring. In a year, a very decent amount can accumulate from such canceled orders.

In the case of holding, money is credited to your account only after confirmation of the availability of the goods for the order, and only at this moment the interest for acquiring is debited.

Soon: When holding a payment, the ability to edit the payment is supported. For example, a customer ordered a phone of a certain brand and color. However, you have a phone of this model, but in a different color. You call the buyer and ask if a different case color will suit him. At the same time, these are two different products in your system, so you enter the order, change one product to another and save the order.

Please note, the product must have the same price as the original one or less. In the second case, the difference in cost will remain on the buyer's account.

Debiting funds from the customer's authorized card according to the order status

This feature also allows you to save on acquiring, but in this case the payment comes without freezing the money in the account. The buyer creates an order with payment after calling the manager. If the buyer does not have a saved card yet, the system prompts him to enter the card details for saving, after which a small amount is debited from the card, for example, 1 or 10 rubles, to confirm the data, then the money is returned to the buyer's account. If there is a card, the buyer chooses the saved card as a means of payment.

The manager calls the buyer, confirms the availability of goods, changes the order status to "Confirmed". After that, the money is automatically debited from the buyer's card.

Please note that in this case there is no guarantee that there is enough money on the buyer's card to pay for the order. If there are not enough funds, the order will receive the status "Transaction failed". But the use of saved payment cards, as an alternative to holding, allows you to edit the order, including with an increase in cost. This scenario is suitable, for example, for the sale of professional cosmetics or sophisticated equipment. The buyer can choose products that are not compatible with each other. Then the manager calls the customer back, discusses replacement options, edits the order and then initiates payment from the saved card.

Creating an order without payment and saving the buyer's card for a subsequent transaction

If the product is located in two or more warehouses, then several orders will be created in the system: parent and child orders, one for each warehouse. In this case, the payment will be made according to the parent order, and it is the child orders that will be relevant in the system. We will have to somehow synchronize the statuses of the parent and child orders, which is not always convenient. It is easier to make payments for individual child orders. However, the buyer is unlikely to want to pay for each of them separately.

Our module allows you to automatically split payments using the same saved cards.

The buyer creates an order, clicks pay, at this point child orders are created, and the payment is automatically divided into two payments using the data of the saved card.

Creating a manual order for a customer

This function is necessary in cases when, after payment, but before receiving the order, the buyer realized that some of the goods in the order did not suit him, but he needed another product with a higher price.

In this case, it is necessary to cancel the order, refund the money and create a new order for a large amount and pay for it. However, the buyer may not want to waste time making a new order.

In this case, if the buyer has a saved card, then you, in parallel with a phone call, can manually create an order for the buyer with the selected goods and make a purchase. The money will be automatically debited from the linked card. For the buyer, the advantage is that he receives the tedious goods without unnecessary movements. For you, the fact that you receive a new order increases the conversion rate.

The owners of stores and marketplaces who are not clean in their hands may try to cash in on this: place orders without the knowledge of customers. However, in this case, after the first complaint from the buyer, the bank quickly freezes the attackers' bank accounts.

Plans: recurring payments

Recurring payments are regular payments to pay for goods or services under a subscription. The peculiarity of such payments is that each payment must strictly meet the subscription amount, if it is 1000 rubles, then 1000 rubles will be debited every month, no more, no less. This means that discounts and promotions cannot be applied to such payments, and if you want to increase the subscription price, you will have to contact the buyer, ask him to cancel the subscription and purchase it at a higher price. We plan to implement this feature in the module by Q4 2023.

However, you can already set up recurring payments using our module "Regular payments and embedded recurring payments". It allows you to set up various payment scenarios, including using promotions or increasing the price. For example, you can offer your customers a subscription for 1 ruble for the first month, charge 500 rubles in the second month, and 1000 rubles for the third, the full subscription price. You can also increase the subscription price, but it is very important to correctly specify this point in the offer agreement. Please contact our manager for advice.

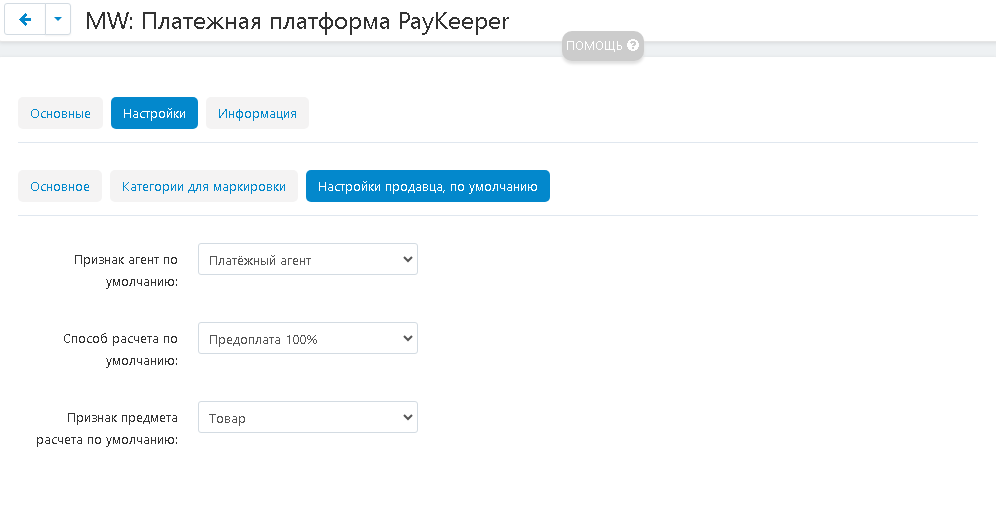

The ability to connect multiple PayKeeper personal accounts

The PayKeeper service supports the ability to connect multiple personal accounts for one business. This allows you to implement various business processes, gives you more flexible settings, and therefore freedom of action.

For example, you can connect the same bank both on the website and in the warehouse accounting program (1C, My Warehouse, Office 365, and so on), CRM, at the point of retail sales, and so on.

There is another advantage of such a system: no more than two banks can be connected in one personal account: one for SBP, the other for card payments. If you have more complex business processes, and there is a need to connect more banks, you can connect several personal accounts with different banks to your site and set up payment through your bank for each of the business processes.

In some cases, it is more profitable to use different legal entities to work with different clients: for the end customer, use an individual entrepreneur, and for legal entities – an LLC. In this case, you can also create a separate personal account for each legal entity.

But whichever option you choose, in any case, all this will work through one cash register.

Online sales register from the PayKeeper payment service

Various cash registers and online sales register services may differ significantly in functionality. Our module works through the PayKeeper payment system and supports all types of cash registers and online cash registers that the PayKeeper service works with.

Stationary cash registers:

- EVOTOR,

- ATOL,

- BARCODE,

- Modulkassa.

Online sales registers:

- PayKeeper Kassa,

- ATOL Online,

- OrangeData,

- Kit Online,

- BusinessKassa.

At the time of publication (November 2023), we tested simultaneous operation according to the scenarios of the online store, marketplace and offline outlet only on PayKeeper Kassa. Check with the manager for the possibility of connecting all three scenarios.

Compatible with other modules

The module is compatible with our delivery modules "Delivery PRO PLUS" and "Russian Post". Together, they support the transfer of information about the delivery tax to the tax service as a service. That is, you pay the shipping tax separately, separately according to the agency scheme for the arrived order.

To work with the module "Logistics: fulfillment, crossdocking, your warehouse, PVZ points" for DBS, FBS and FBO business processes, we have added an additional setting. You can activate different payment methods for each of the business processes. To do this, it is enough to specify that the payment method should be hidden if the order includes goods from cross-docking warehouses.

Usage example: when using the cross-docking model, the marketplace cannot be sure that the seller has all the goods in stock. Therefore, it is not profitable for the marketplace to immediately take money from the buyer: if it turns out that there is no product, then the money will have to be returned. At the same time, the payment for acquiring, which is from 2.5 to 4%, is not refundable. From each product, it seems, not such a large amount. But if there are a million rubles worth of such refunds in a year, which is quite likely, then the losses will amount to about 40 thousand rubles. Which is already noticeable.

To avoid this, you can hide the possibility of paying by card for those orders where goods from the cross-docking warehouse are involved. Leave only payment options after receipt, discuss with the manager, payment by SBP and the like. Acquiring is also charged for the SBP, but there the payment amount is only 0.7%, which hits the wallet much less.

Soon: In the near future, the module will be able to hide not only its own payment methods, but also third-party ones created using basic functionality or other payment modules, depending on the availability or absence of warehouses. For this function to work, you will need to install the "Basket Division" module for the online store. For the marketplace, it will be possible to use the standard functionality of dividing baskets.

Usage example: the customer selects the orders and puts them in the cart. The algorithm automatically divides the products into two baskets. There are products in one that are definitely in stock. Instant payment methods are displayed for this shopping cart: card payment, SBP, credit, and so on.

The second basket will contain goods, the availability of which will need to be checked with the supplier or vendor before withdrawing money from the buyer. For this basket, only payment methods are displayed that provide time to check the availability of goods before payment: discuss with the manager, holding, payment upon receipt, and so on.

Then the manager checks the availability of goods in stock, corrects the order if necessary, and only after that the buyer is charged for the order.

You can flexibly build a display of payment methods depending on the required logic of payment behavior. At the moment, none of the modules presented in the mass market has the same functionality as ours.

Paid and free versions of the PayKeeper integration module

We offer you two module options:

- Free with reduced functionality,

- Paid with fully functional functionality.

The free version only accepts payments.

We offer you a module that allows you to realize all the possibilities provided to you by the bank. With it, you will be able to implement many different scenarios that match your business processes.

We are constantly improving and developing the module, adding new functions to it. At the moment, we are preparing the possibility of transferring information to 1C via the API. Data is currently being collected for the implementation of electronic document management.

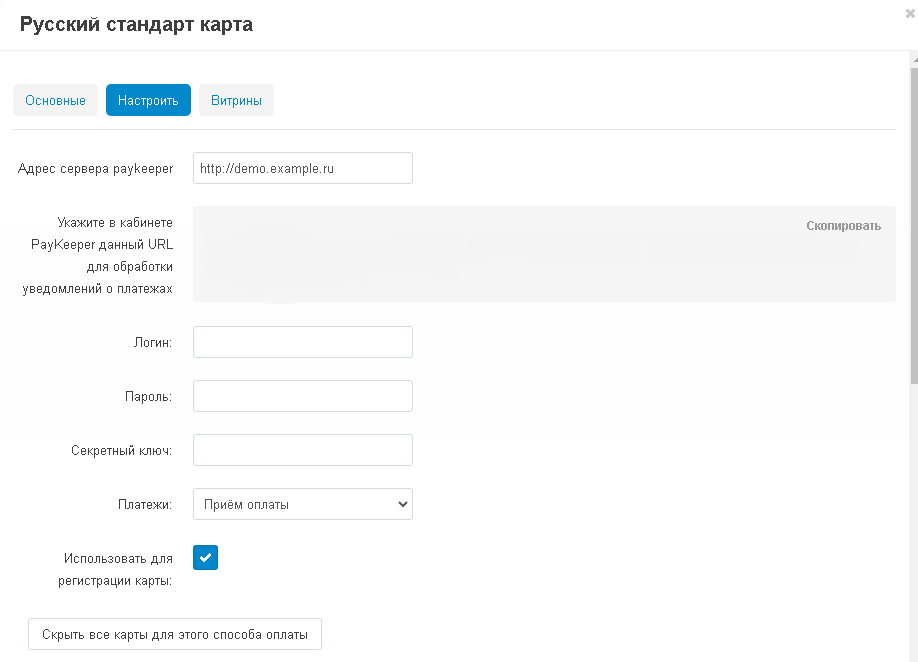

Free connection to the Russian Standard bank through the PayKeeper service

You can connect to the bank directly for free by contacting their manager and notifying them that you will work through the PayKeeper service. Or you can connect directly through the PayKeeper service. To do this, contact the service manager and notify which bank you plan to cooperate with. The manager will contact the bank's staff on his own.

If you connect to the bank through the PayKeeper service, the service provides a discount on acquiring payments: 1.9% for card payments and 0.7% for SBP. When connecting to the bank, the bank's commissions will apply.

If you want to connect more than one bank to your site, for example, one for card payments and another for SBP, then you need to use one of two modules:

- Russian Acquiring – more than 20 banks, online cashier, OFD, payment via Visa; MasterCard; Mir, UnionPay; SBP for CS-Cart Multi-Vendor marketplace?

- PayKeeper – Visa; MasterCard; Mir, UnionPay; SBP, online cashier, OFD, more 20 banks for CS-Cart and Multi-Vendor.

CONTACTS

Up-to-date information about changes in the module's functionality, as well as compatibility with other modules, is published in our Telegram channel and in the groupVKONTAKTE

Telegram t.me/maurisweb

VKONTAKTEvk.com/maurisweb

You can submit a request to the support service, ask questions to the managers about the work or completion of the module via messengers, the group VKONTAKTE and mail.

- WhatsApp +7-923-364-90-07

- Telegram t.me/mauriswebru

- Telegram +7-923-364-90-07

- VKONTAKTEvk.com/maurisweb

- E-mail: info@maurisweb.ru